Investment funds and asset management market in Poland, edition 2021

After multiple years of stagnation, the asset management sector experienced solid growth in H1 2021. Total assets* increased to PLN 702 billion in H1 2021 driven by favourable performance, a few consecutive quarters of positive inflows and an extra boost provided by the launch of new 3rd pillar vehicles (PPK).

The outlook

Overall assets under management in Poland are expected to grow steadily in 2022 and in following years while negative real interest rates, which are likely to persist, will further benefit investments linked to capital markets relative to no interest bank deposits. Besides investment funds, which are gaining interest of retail investors, it is also the 3rd pillar pension segment which will experience significant new flows with defined contributions driving AuM over initial years of the programme.

* Across key categories: Investment funds, Insurance assets, Pension assets (2nd and 3rd pillar); Excluded are bank and structured deposits, equities and bonds held directly by private individuals

--------------------------------------------------------------------------------------------------------------------------------------

Table of contents

1. Executive Summary

2. Asset Management Market

Slide 1: Asset management market in Poland: Key Segments, 2021 H1

Slide 2: Assets under management evolution, 2017-2021 H1

Slide 3: Top asset managers (groups) by AuM, 2021 H1

3. Investment Funds

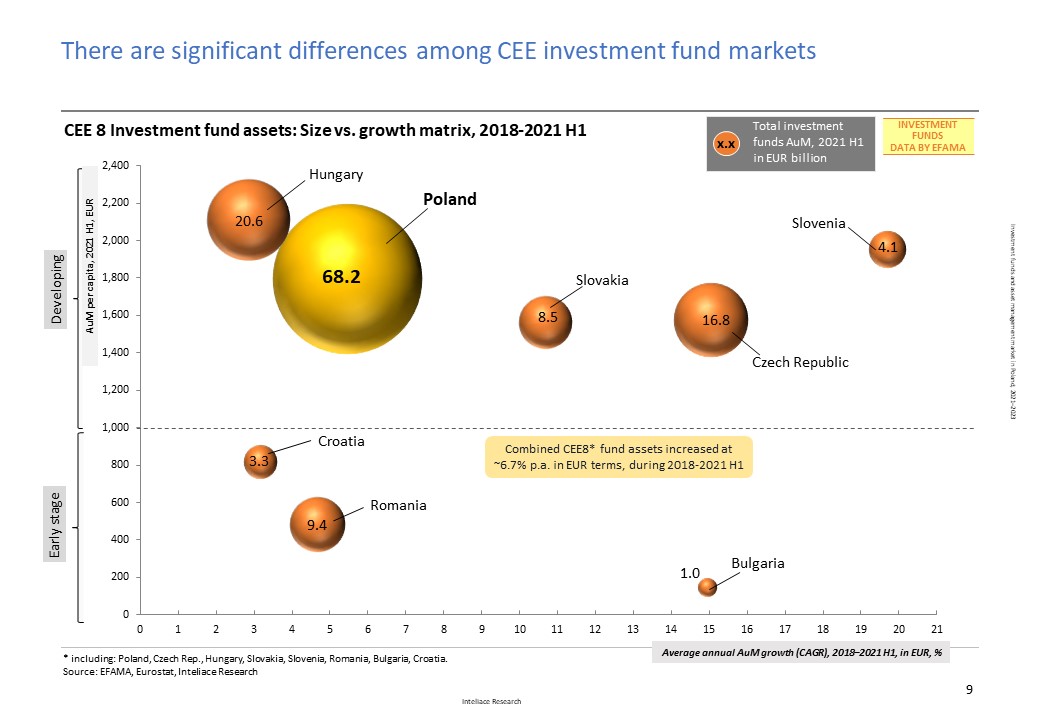

Slide 4: CEE 8 Investment fund industry – size vs. growth matrix, 2018-2021 H1

Slide 5: CEE investment funds penetration benchmarks, 2021 H1

Slide 6: Evolution of assets, number of funds & managers 2016-2021 H1

Slide 7: Fund assets by type of fund (open-end, closed), 2016-2021 H1

Slide 8: Fund assets by type of fund (public/non-public assets), 2016-2021 H1

Slide 9: Fund assets by underlying asset mix, 2018-2021 H1

Slide 10: Top 10 players in investment fund market, 2021 H1

Slide 11: Market share evolution of top fund managers, 2019-2021 H1

Slide 12: Distribution – online distribution platforms, 2021

Slide 13: Investment fund assets flows, 2018Q1-2021 Q2

Slide 14: Fund assets structure – by declared investment profile, 2021 H1

Slide 15: Ownership of funds by groups (retail/financial/other), 2016-2021 Q1

Slide 16: Local funds invested in foreign assets and foreign funds, 2021 H1

Slide 17: Assets of foreign funds, 2016-2020

Slide 18: Fees and commissions charged by top fund managers, 2021 Q3

Slide 19: Revenues and costs of fund managers, 2020

Slide 20: Profitability tree for fund managers, 2017-2020

Slide 21: Regulations: The new fixed fund management fee cap

Slide 22: Top players' profiles - Ipopema TFI

Slide 23: Top players' profiles - PKO TFI

Slide 24: Top players' profiles - PZU TFI

Slide 25: Top players' profiles - Pekao TFI

Slide 26: Top players' profiles – NN IP TFI

Slide 27: M&A transactions including fund managers in Poland, 2010-2016

Slide 28: M&A transactions, 2017-2019

4. Pension Funds

Slide 29: Composition of the pension sector in Poland

Slide 30: Pillar II: Assets, members, average account value, 2017-2021 H1

Slide 31: Pillar II: Pension top asset managers, 2021 H1

Slide 32: Pillar II: Pension managers profitability tree, 2017-2020

Slide 33: Pillar III (Voluntary) - Assets, members, 2018-2021 H1

Slide 34: Pillar III – New regulations - PPK (3rd pillar) vehicles

5. Insurance Assets

Slide 35: Technical reserves by type evolution, 2016-2021 H1

Slide 36: Technical reserves by segment and by company, 2020

Slide 37: Profitability of life insurers, 2016-2020

Slide 38: Profitability of non-life insurers, 2016-2020

6. Forecasts

"

Slide 39: Asset Management Market: Mid-term forecast: investment fund

assets, pension assets (p2, p3), insurance investments, 2021-2023"

7. Notes on methodology

End of report.

Investment funds and asset management market in Poland, 2021

Investment funds and asset management market in Poland, 2021